Direct Deposit

Direct Deposit

Skip standing in line at the credit union. Instead, have your regular paycheck or Social Security, retirement, military, or other benefits deposited automatically and immediately into your CRCU account up to 2 days early* with direct deposit. It saves you time and couldn’t be easier.

How to get it

To sign up for direct deposit, complete the form you receive from your employer or other payer with the following information:

- Your 14-digit CRCU account number (MICR)

- Our CRCU routing/transit (ABA Number): 313077513

- Our mailing address and phone number:

Community Resource Credit Union

P.O. Box 3181

Baytown, TX 77522-3181

(281) 422-3611 or (800) 238-3228

Or, you may also print and complete our DIRECT DEPOSIT FORM and give it to your employer.

CRCU's Routing Number: 313077513

What is an ABA Routing Number?

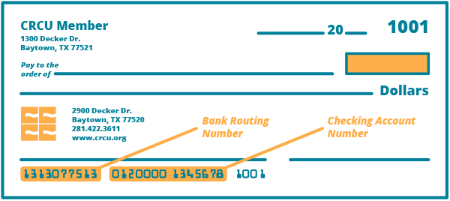

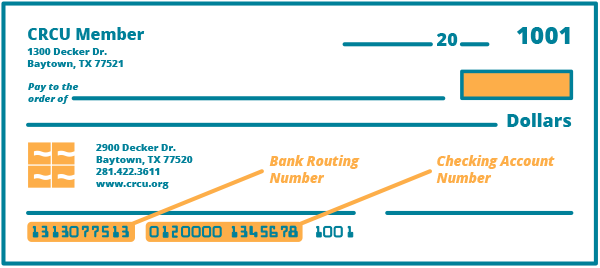

.png) Find Your Account (MICR) Number on Your CRCU Checks

Find Your Account (MICR) Number on Your CRCU Checks

You can also find your account number (MICR) on your checks. Take a look at the numbers lining the bottom of each check. CRCU's routing number will be the first, 9-digit number at the bottom of the check followed by your 14-digit account number (MICR).

- Deposits funds faster than paper checks with Early Direct Deposit

- Free service

- Completely automated, so there’s no need to stand in line or visit the branch

- View your deposit through CRCU Online Banking or Mobile Banking

- Can be used for checking or savings accounts

- Provide your account number (MICR number) and CRCU routing number to your employer or payer to have them set up direct deposit service with CRCU

Additional Resources

Take advantage of our convenient online services that are designed to save you time.

Learn More

Save Time By Banking On The Go With The CRCU Mobile App!

- View account balances

- Transfer funds

- Make loan payments

- Pay bills

- Deposit checks

CRCU Routing Number

CRCU's Routing Number: 313077513

What is an ABA Routing Number?

Find Your Account (MICR) Number on Your CRCU Checks

Checkbook & Checks

.png)

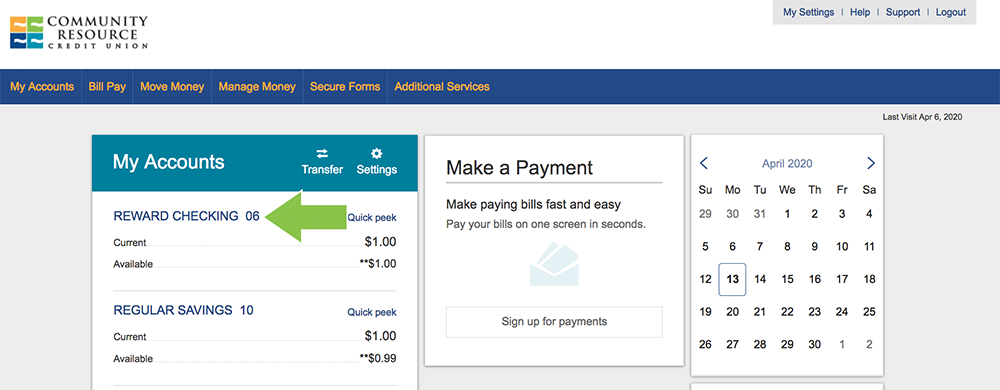

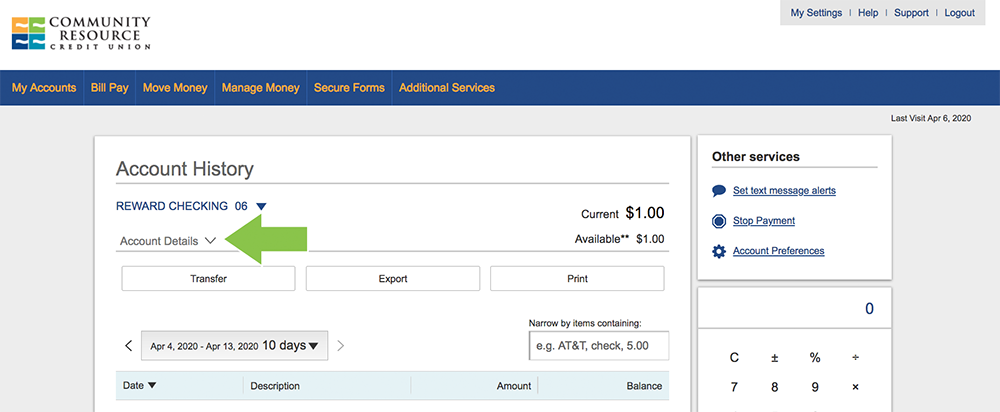

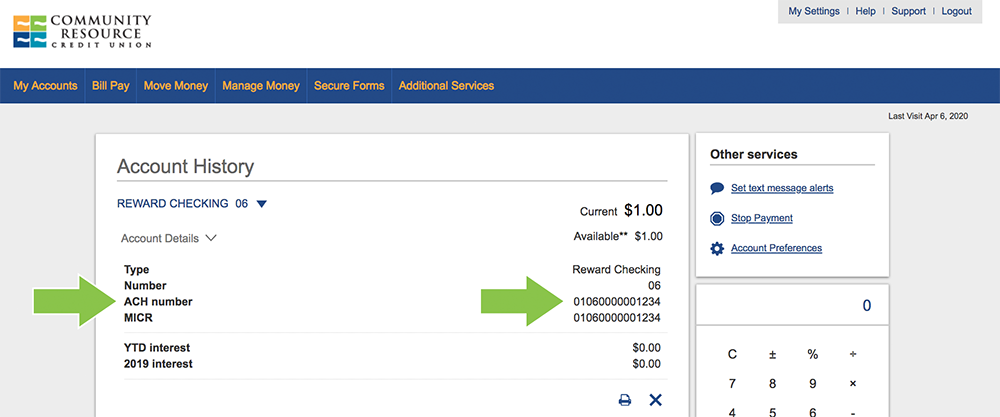

Find Your Account (MICR) Number Within CRCU Online Banking

FAQs

Frequently Asked Questions

How can I find out if the direct deposit transaction was completed as directed?

View your account online through Online Banking or Mobile Banking. Contact CRCU for more information.

What is a MICR Number?

Magnetic Ink Character Recognition number that allows financial institutions to process checks and ACH. It is the same as your account number.

Where can I locate my share product MICR Number?

Access home or mobile banking, locate your share product, and select detail for the product information for each share.

How To Create a Budget in 6 Easy Steps

Do you have a budget? It’s not as hard as you might think to make one. We’ve got a simple six-step process that will have you in full command of your finances in no time!

All You Need to Know About Going Cashless

If you’re thinking about adopting a cashless lifestyle or you think the world is headed in that direction, you might be right … but we’ve got a look at both sides of the issue!

Your Complete Guide to Identity Theft Protection

If you’re not worried about identity theft, you should be! We’ve got a list of simple steps you can take to keep yourself out of the thieves’ cross-hairs!

(1).png)