Mobile Check Deposit

Depositing checks is just a snapshot away!

Deposit a Check - Anytime. Anywhere.

This secure and easy timesaver lets you deposit any check from anywhere, anytime, using your mobile device. It’s the power of a CRCU branch in the palm of your hand.

What to know

- Mobile Check Deposit Rule: All checks deposited via mobile must include "For Mobile Deposit Only" handwritten below your signature in the endorsement area on the back of the check or the deposit may be rejected. If you have any questions please call us at 281.422.3611 or 800.238.3228.

- Mobile check deposits are subject to an automatic hold from 7 up to 10 business days.

- Eligibility for Mobile Check Deposit is subject to credit union approval. To check eligibility, please call our Member Contact Center at 281.422.3611.

- Mobile Check Deposit is free; however, usage rates from your mobile carrier may apply.

Why it’s great

- Superior security for peace of mind

- Fast, saving you time and trips to the branch

- Accessible right through your iPhone® or Android™ device

- Anywhere, anytime convenience

- Easy, with deposits completed with just a few snaps of your device

How to get started

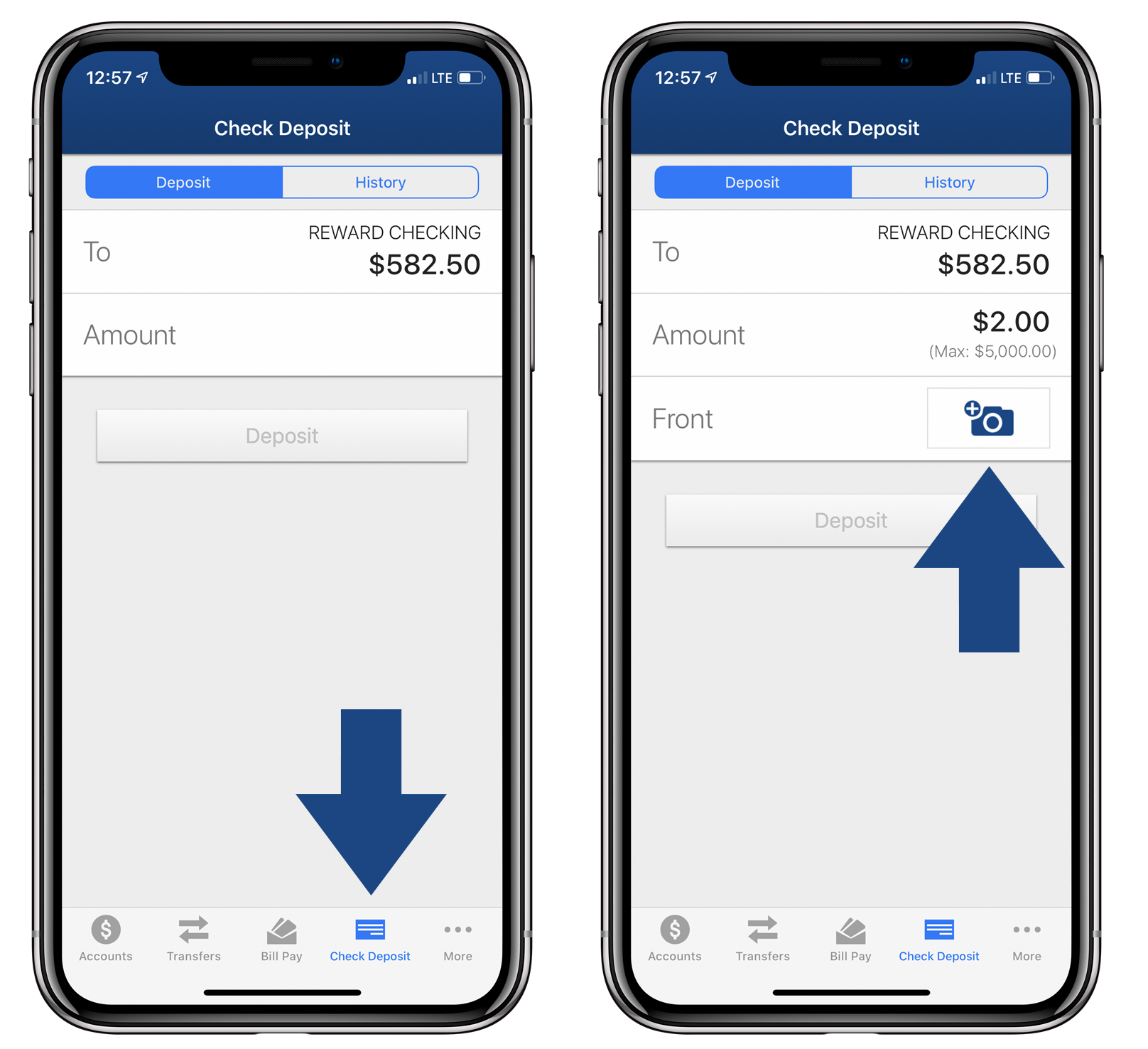

How to get started? Just use your CRCU Online Banking username and password to log into your CRCU Mobile Banking app. From there, you simply:

- Choose mobile deposit and select the account for the deposit.

- Endorse your check and write “For Mobile Deposit Only” below your signature.

- Place your check on a dark, non-reflective surface to snap a picture of the front and back of your check

- Verify and submit your deposit.

That’s it! When you’re done, we’ll send you a quick email to let you know we’re taking care of the rest. You’ll want to retain the check for 30 days – and then shred it.

Tips for a Successful Mobile Deposit

- Ensure your check is properly filled out and is legible. Endorse your check before taking the photos.

- When taking a picture of the check, place the check on a dark, non-reflective surface and flatten out the check.

- Make sure the entire check is displayed in the camera box; position your mobile device's camera directly over the check to capture a clear image.

- Important: Ensure you take a picture of the entire check, both the front and the back. Partial check images will automatically be rejected by the system.

- Preview the photo. If it is blurry or not legible, retake the photo.

- Retain the check for 30 days. At that time you may destroy it; shredding is a secure way to dispose of a check.

Conveniently pay bills any time, any where with CRCU's online bill pay service!

- Pay all your bills from multiple accounts in one convenient tool

- Track payment history

- Save money – no more buying stamps

- Save time – no more writing checks out by hand

Eligibility for Mobile Check Deposit is subject to credit union approval. Mobile Check Deposit is free, however, usage rates from your mobile carrier may apply when using the Mobile Check Deposit App. To check eligibility, please call our Member Contact Center at 281.422.3611.

iPhone® is a trademark of Apple, Inc., registered in the U.S. and other countries. App Store is a service mark of Apple, Inc. Android™ and Google Play™ are trademarks of Google, Inc. CRCU is not endorsed, sponsored, affiliated with or otherwise authorized by Apple, Inc. or Google, Inc.