Gap Protection

Guaranteed Asset Protection (GAP)

What is GAP?

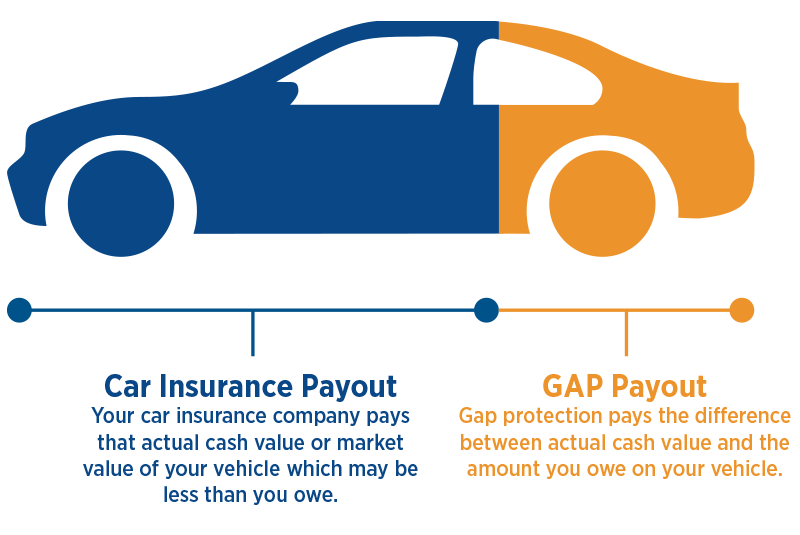

Guaranteed Asset Protection (GAP), is a voluntary, non-insurance program that works with your standard car insurance. It protects the “gap” between the vehicle’s actual cash value (ACV) and the amount you still owe on your loan if your vehicle is totaled or stolen.

- May help the borrower avoid financial hardship and afford a replacement vehicle

- May prevent a deficiency balance from being added to any new loan

- 60-day refundable "free look" period for peace of mind

- No model, mileage, or year restrictions

- GAP may cover up to $1,000 of the borrower's insurance deductible

- GAP also covers Vans, Light trucks, ATVs, Motorcycles, Jet Skis, Snowmobiles, Boats, Travel Trailers and Motor Homes

- Policy includes Auto Deductible Reimbursement benefit (ADR) (see below for more information)

What to know

- GAP Protection helps pay off your remaining loan balance if your auto is stolen or damaged and is deemed to be a total loss

- GAP covers the difference between the borrower's outstanding loan balance at time of loss and the actual cash value (ACV) of the vehicle

- A GAP claim must be filed within 60 days from the date of the primary carrier's settlement or within 60 days from the date of loss if there is no primary carrier

- The loan must be financed with Community Resource Credit Union

- Gap can cover up to the maximum amount of 125% of vehicle value at time of the loan.

- For New MSRP will be used as value, if Used Retail will be used as value.

- The fee can be financed with your loan or debited from your account

- GAP claim may be started on your behalf as soon as check from your insurance company is received.

- Total Loss Claim processes can take up to several weeks to be finalized. Any payments due within this time is the borrower’s responsibility to be paid until loan is paid in full.

- CRCU advises the borrower to continue to make payments on the loan. Payments made after the date of loss may be refunded as part of the GAP settlement.

- GAP does not pay for any interest after the date of the loss.

- GAP does not cover any late payment fees, delinquent payments, loan extensions, or Skip a Pays in excess of one per year.

- GAP will not pay if the vehicle was totaled due to the driver of the collateral being under the influence.

- GAP does not cover deductions made by insurance company.

- GAP does not cover refundable cancelable products, for example extended warranty.

Required Documents for GAP Claim

How to file a GAP Protection claim if you purchased GAP thru CRCU:

- If you have experienced a total loss of your vehicle, you will need to make an insurance claim with your vehicle insurance company first.

- After initiating the claim process with your insurance carrier for the total loss, contact CRCU with the following information to get process started on your GAP claim. Please provide the following information:

- Vehicle Information (Year, Make, Model, VIN)

- Vehicle Mileage at time of Loss

- Date of Total Loss

- Type of Loss (collision, stolen, flooded)

- Insurance Claim Number

- Insurance Company

- Insurance Phone Number

- Insurance Settlement Amount

How to file a GAP Protection claim if you purchased GAP thru dealership:

- If you have experienced a total loss of your vehicle, you will need to make an insurance claim with your vehicle insurance company first.

- After initiating the total loss claim process with your insurance carrier for the loss, contact GAP.

- GAP policy information can be found from the contracts signed at the dealership where you purchased your vehicle.

- After initiating the claim process with your insurance carrier for the total loss and GAP Claim process with dealership contact CRCU to provide the status of your claims.

- If you need any assistance in providing GAP or dealer documentation please visit your nearest CRCU branch or call (800) 238-3228.

What is Auto Deductible Reimbursement (ADR)?

Included in the GAP policy is a Deductible Reimbursement benefit. The Deductible Reimbursement benefit pays up to $500 per loss (unlimited losses per year) when a claim is filed and paid with the primary insurance carrier.

What to know

- Pays up to five hundred dollars ($500) per Loss (UNLIMITED losses per year) when a Loss is filed and paid by the auto insurance company for a Covered Auto the Member owns or leases evidenced by the title, registration or loan document

- AND insured under an Auto Insurance Policy designating the Member as the Named Insured.

- Loss means an event for which the auto insurance company has approved and paid a collision or comprehensive claim which exceeds the Auto Insurance Policy deductible for the Covered Auto.

- Coverage is effective upon date of enrollment and will continue for 3 year(s) depending on the benefit period provided.

How to file an ADR claim

- Call the Claims Administrator at 1-877-296-4892 OR go to assuranceplus.com/claims to request a claim form.

- Notice of the Loss must have been provided to the Claims Administrator within 90 days of the date of Loss, but in no event later than 1 year from date of Loss.

- To process a claim the Claims Administrator must receive a completed and signed claim form, along with all required documents, within 180 days of the date of Loss, but in no event later than 1 year from date of Loss. Download ADR Brochure

How to get yours

Join The CRCU Family Today

Are you ready to join the credit union that puts you first? Become a member of the CRCU family and you’ll start enjoying the great rates, personalized financial advice, and excellent customer service CRCU is known for.