Wire Transfers

Move money between your CRCU account and any account at a financial institution.

Wire Transfers

Wire transfers allow you to move money between your CRCU account and any account at another financial institution. It’s easy, automatic, secure, and can be used to move money across the globe.

Why it’s great

- Electronically send funds to or from someone at another institution

- Fully automated, with no waiting in line and no paper items to be issued or mailed

- Faster availability of funds

- Available for both domestic and international funds transfers

What to know

- We have no control as to when the funds will be posted at the receiving financial institution

- A fee may be accessed at the receiving financial institution

- For international wire transfers, a US correspondence bank must first receive the funds and then send them to the receiving financial institution

- Completed form must be received by noon to be sent on the same business day

How to do it

Outgoing Wire Transfers

- U.S. dollar amount

- Member’s phone number

- Name of the U.S. bank or Institution

- Routing and transit number of the receiving institution (ABA or routing number)

- Physical address of the receiving bank, including city, state and zip code

- Name of the person or company receiving the funds

- Physical address of the person or company, including city, state and zip code

- Account number where the funds will be deposited

Incoming Wire Transfers

Wire to:

2900 Decker Drive, Baytown, TX 77520

- Your full name

- Physical address

- Your CRCU Account number & type

Wire Transfer Agreement

- Domestic Wire Transfer

- International Wire Transfer

- Sign and submit the Wire Transfer/ACH Origination Request if you have not already submitted one

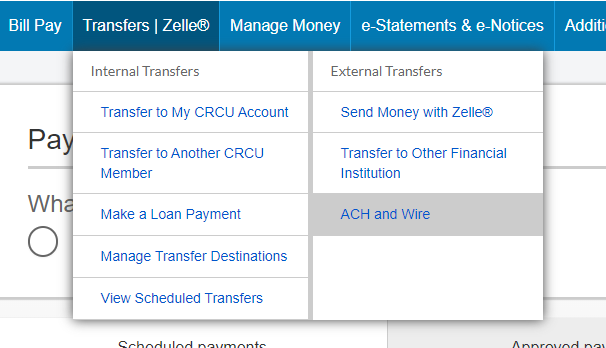

Contact Member Services at 281.422.3611 if you have questions about

wiring instructions.

Zelle

FAQs

Frequently Asked Questions

When will the wire transfer funds be received?

We have no control as to when the funds will be posted at the receiving financial institution. Contact CRCU for information.

Why did I receive less funds then the amount transferred?

Some financial institutions charge an incoming wire fee. Contact the receiving financial institution for wiring instructions.

Why do I need a US correspondent bank for international wire transfers?

The financial institutions that process our wire transfers do not process international wires. They must process it to a US correspondent bank and then to the receiving financial institution in the other country. Some US correspondent banks only process transfers to specific international banks.

What are the wire limits for domestic wires via online banking?

- Daily Limit – 5000

- Monthly Limit – 7000

- Transaction Limit – 2999

- Price per Domestic Wire transaction – 15